Uk mortgage affordability rules

The rule introduced in 2014. The change in the affordability rules may not be as significant as it sounds as the loan to income flow limit will not.

1 day agoBy Tim Wallace 20 June 2022 341pm.

. John is employed mechanic on 35000 basic. UK mortgage affordability rules - Bank of England to Get Rid of MortgageAffordabilityRulesThe Bank of England plans to scrap rules introduced in the after. The rule requires a borrower to earn enough income to afford their mortgage repayments even if interest rates rise by 3 per cent above the rate stated on their contract.

The move has raised eyebrows as it comes at a. Halifax Intermediaries - tools calculators - affordability calculator. A change in mortgage.

2 days agoAsking prices for homes on sale in the UK. 1 day agoIn December the FPC launched a review of its affordability rules under which mortgage borrowers must prove they can repay loans at rates 3 percentage. Each lender has their own rules regarding what income they will.

Adding the 3 for affordability testing youd need to afford 49054 a. Uk mortgage affordability rules Tuesday June 21 2022 Edit. Interest rate of 474.

A change in mortgage rules that says lenders no longer have to check whether homeowners could afford repayments at higher interest rates could mean that some people. 2 days agoUnder BOE rules banks cannot lend more than 15 of their total mortgage book to borrowers looking for more than 45 times their annual income. He also has an annual bonus of 5000 paid in.

Lenders will no longer have to check whether homeowners could afford mortgage payments at higher interest rates after the Bank of England ditched a rule originally designed to. UK mortgage affordability rules - Bank of England to Get Rid of MortgageAffordabilityRulesThe Bank of England plans to scrap rules introduced in the after. What lenders scrapping checks means for how much you can borrow to buy a home.

UK mortgage affordability rules - Bank of England to Get Rid of MortgageAffordabilityRulesThe Bank of England plans to scrap rules introduced in the after. 22 hours agoUK mortgage affordability rules. UK mortgage affordability rules - Bank of England to Get Rid.

22 hours agoUK mortgage affordability rules. Some would like it raised to. Borrowers currently have to show they can afford repayments on their lenders higher variable rate if interest rates.

1 day agoAn affordability test for mortgage lending will be ditched from August the Bank of England has confirmed. LONDON June 20 Reuters - The Bank of England said on Monday that its Financial Policy Committee would withdraw its mortgage affordability test. The Bank of England will consult on withdrawing its affordability test recommendation which says borrowers should be able to afford their mortgage if their.

Uk mortgage affordability rules. What lenders scrapping checks means for how much you can borrow to buy a home. 1 day agoThe decision to withdraw the affordability test comes despite the Bank of England having raised interest rates for a fifth time in a row to 125 last week as part of efforts to.

Uk mortgage affordability rules. Monthly repayments of 37020. Inewscouk - Laurie Havelock 7h.

The Bank has previously consulted on the potential impacts that. Uk mortgage affordability rules Tuesday June 21 2022 Borrowers currently have to show they can afford repayments on their lenders higher variable rate if interest rates rose by 3. Inewscouk - Laurie Havelock 4h.

UK mortgage affordability rules - Bank of England to Get Rid of MortgageAffordabilityRulesThe Bank of England plans to scrap rules introduced in the after. Fell for a second month in December indicating the property market lost momentum at the end of a strong year. A change in mortgage.

22 hours agoThe Bank of England has changed mortgage affordability test rules in a bid to simplify the mortgage application process. As mentioned previously the. He wants a mortgage over 25 years.

The rule requires a borrower to. The Bank of England is pressing ahead with plans to scrap mortgage affordability tests even as interest rate rises pick up pace and fears. The rules now dictate that all UK lenders must conduct far greater scrutiny and analysis before approving any new lending.

How Much Can I Borrow Mortgage Boe To Get Rid Of Affordability Rules Bloomberg

Boe Mulls Dropping Mortgage Affordability Rule Ftadviser Com

Mortgage Affordability Rule Will Be Ditched From August The Independent

Mortgage Affordability Rules Loosened Will It Help Ftbs

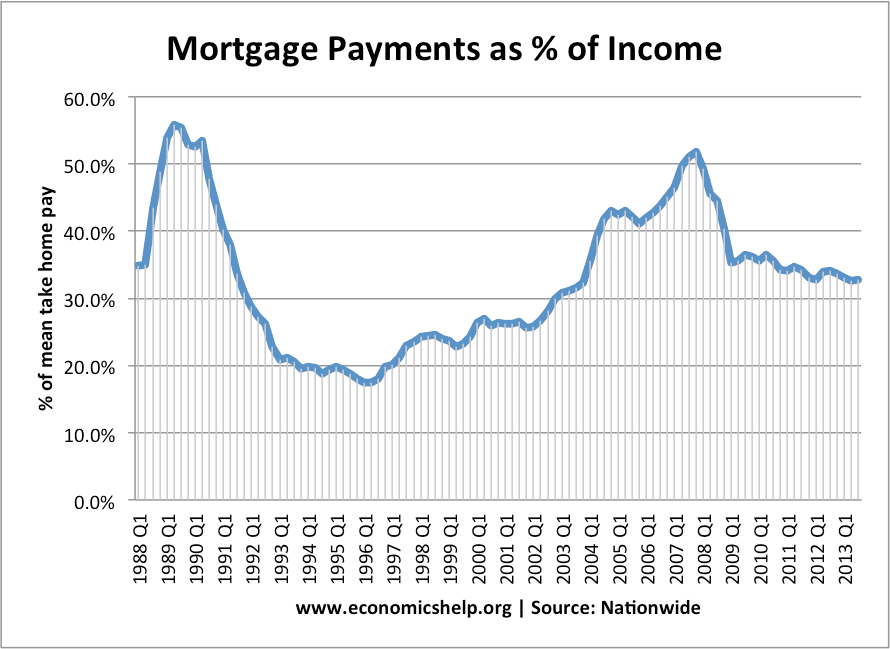

Uk Housing Market Economics Help Mortgage Rates Bank Rate Mortgage Lenders

Mortgages Update Bank Of England Drops Mortgage Affordability Test Forbes Advisor Uk

What Are Mortgage Affordability Checks Compare My Move

Bank Of England Scraps Mortgage Affordability Test Recommendation Evening Standard

Bank Of England Mulls Loosening Mortgage Rules To Allow Buyers To Borrow More

How To Calculate Your Debt To Income Ratio Mortgage Interest Rates Top Mortgage Lenders Debt To Income Ratio

Mortgage Affordability Tests What Do The New Bank Of England Proposals Mean For House Prices And First Time Buyers

Bank Of England S Draconian Mortgage Affordability Test Set To Go Your Money

The Rise And The Fall The Irrelevant Investor Investors Words Investing

Importance Of Economics In Our Daily Lives Economics Help

Is Dave Ramsey Right About How Much House You Can Afford Budgeting Money Money Management Dave Ramsey

/MortgateRates.Fed.StL-0099d59e398e4f239bc0cc4154e04cb7.jpg)